International travel insurance is not the most interesting topic in the tourism industry. Actually, it’s pretty boring. However, it is really important. This decision could save you thousands of dollars and be the difference between high-quality medical care and something else. Learn from our experiences – yes, it is necessary.

Having travel health insurance covers you when things go wrong. There are number of companies out there, but Travel Guard and Travelex are the two we’ve used repeatedly over the years. They each offer comprehensive insurance options which cover you for health and medical problems, accidents and emergencies, inconveniences (trip cancellation, trip interruption or trip delays), and even lost or delayed baggage. Why do you need it? Let’s look at some of our experiences.

If you’ve read this site for any length of time, you know that our trips have sometimes been plagued by misadventures. I almost died in Peru from food poisoning. OK, that’s probably an exaggeration, but it wasn’t good: doctors were consulted, medication was administered, flights were missed, emergency transportation was secured, the trip was almost ruined and there were definitely moments in which I thought I was going to die. You can never predict when Murphy’s Law will strike.

And you’d think I would have learned that lesson. But no. I did it the whole food poisoning/hospitalization thing all over again in Croatia.

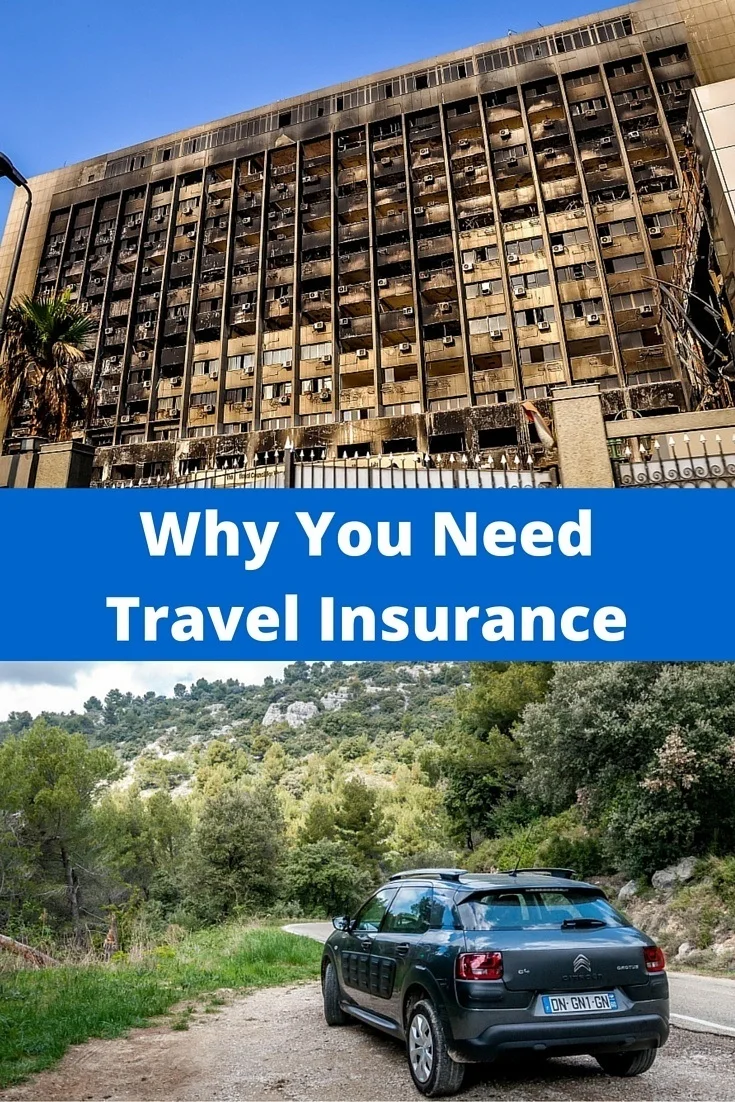

But that’s hardly the only time things have gone wrong. I was caught in the middle of a civil war in Nepal. We went to Egypt immediately after the revolution and during a period of significant political tension and uncertainty.

There have been minor “automotive mishaps” in Ireland (twice), Italy, Germany, and South Africa.

Laura severely sprained her ankle…twice (once in Italy and again in Slovakia). I sliced my leg open walking down the beach in St. Kitts (don’t even ask how I managed that!).

I’ve fallen and nearly broken my left knee three times: in the Galapagos Islands, North Macedonia, and Wales. Then I had another round of food poisoning that left me hospitalized in Croatia.

And then there was our worst travel accident yet: the scooter crash in Bermuda that left us with broken toes and and a severe case of “road rash.” We both got pretty banged up. And then Laura’s leg got infected requiring a middle-of-the-night trip to the hospital for IV antibiotics. It was really scary at the time and it could have been much, much worse for us.

We’ve had delayed baggage on several trips to the Caribbean and also Italy. And then on a trip to Albania, the airline lost my bag for over 3 months.

And then there are the natural disasters. We were in an earthquake in Italy, our first trip to Iceland was threaded between two separate volcanic eruptions, a trip to the Middle East was nearly cancelled due to a massive snowstorm in the U.S., and trips to South Africa and Iceland were cancelled due to the virus outbreak.

Do You Need International Travel Insurance?

Strictly speaking, no. There’s no law that says you are required to purchase it. That doesn’t mean you should automatically skip it. Some tour providers require their guests to have it (it reduces their legal liability). Even if they don’t, you may still want it – if something goes wrong, you never know what contingencies your trip provider may have in place.

Selecting the Right Policy

We usually buy travel insurance on most of our major trips. We always buy it if we will be driving overseas. If we’ll be in a place that is remote, prone to natural disasters, or we’re going at a time when weather could be problematic, we get a policy. The more money we spend on a trip, the more likely we are to buy insurance.

Our Recommendation

This is not something people think about, but you should. Companies like Travel Guard and Travelex offer broad coverage packages starting for less than $50. That’s a small price to pay to offset your risk of something catastrophic happening. And that’s why we buy it.

Have you ever been in a situation where you needed travel insurance?

Legal notice: This information is provided for informative and educational purposes. We are journalists, not insurance agents. These plans provide coverage that only applies during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of this policy with your existing life, health, home, and automobile policies, as well as any benefits that may be offered by your credit card company. If you have any questions about your current coverage, call your insurer or insurance agent or broker.

Lance Longwell is a travel writer and photographer who has published Travel Addicts since 2008, making it one of the oldest travel blogs. He is a life-long traveler, having visited all 50 of the United States by the time he graduated high school. Lance has continued his adventures by visiting 70 countries on 5 continents – all in search of the world’s perfect sausage. He’s a passionate foodie and enjoys hot springs and cultural oddities. When he’s not traveling (or writing about travel), you’ll find him photographing his hometown of Philadelphia.

Lynn Jackson

Wednesday 12th of February 2020

I looked at both of those companies and they are costing over 150-300 for a 3000 trip which is just the cost of the flights for two of us. Please advise!

Jan

Tuesday 27th of August 2019

Thank you for writing about travel insurance. It's so important. I slipped and fell once in Turkey, andhad to be taken to the hospital. I was very impressed with the German hospital (spoke perfect English) in Istanbul. The doctors were wonderful. And my travel health insurance paid the bill. Thank goodness!

Lance Longwell

Tuesday 27th of August 2019

Last week we just had our own accident overseas. A more complete article will be coming soon. But we were both very glad we had international travel insurance.